CBDC+: Innovative Solution for Enhancing Central Bank Digital Currencies

CBDC+: Innovative Solution for Enhancing Central Bank Digital Currencies

Proposal for extending CBDCs to facilitate and expedite their implementation

© 4. dubna 2023, Pepe Rafaj a spol.

I. Introduction

Central Bank Digital Currencies (CBDCs) bring a range of benefits, such as improving financial stability, reducing transaction costs, and promoting digital and financial inclusion. However, traditional CBDCs have their limitations. One of the main concerns about CBDCs is the potential loss of privacy and the possibility of monitoring or limiting financial transactions.

CBDC+ is an innovative concept that presents an enhanced version of CBDC, supplemented with elements of stablecoins, smart contracts, multicurrency, and CBDR (Central Bank Digital Receipts) solutions so that an adequate payment instrument for the future can emerge based on new insights and technologies.

This article focuses on the advantages and possibilities of CBDC+.

II. Definition of Payment Methods

Table 1

Table 2

III. What is CBDC+ then?

CBDC+ is a concept that combines key aspects of CBDCs with other technologies and solutions that help improve their functioning and reach. Specifically, CBDC+ includes:

III.1. CBDC as a "Stablecoin"

In the CBDC+ concept, central bank digital money can be viewed as "stablecoins," whose exchange rate to fiat currency is guaranteed by the central bank. This view changes the original paradigm but allows for easy and instant integration into:

III.1.A. existing cash register and payment systems provided by banks or payment institutions,

III.1.B. third-party digital wallets and citizens' payment cards, and

III.1.C. especially the entire business "ecosystem".

It can be assumed that the "CBDC = stablecoin" concept is inevitable, as it will arise from evolutionary development.

III.2. Smart Contracts

Opponents of CBDCs fear the introduction of the "Big Brother" concept, which is a huge misunderstanding of the whole issue of digital money and democracy. Just as we trust GDPR, laws, courts, governments, voters, or mathematical, physical, and natural laws, we should trust smart contracts.

A smart contract is a form of (simple) contract governed by an algorithm, i.e., a set of defined states that, when they occur, trigger certain actions (e.g., execution of a payment). In the world of CBDC+, smart contracts could play a key role in improving the transparency and efficiency of financial transactions.

III.3. Multicurrency

CBDC+ supports the idea of multicurrency, which means that individual CBDCs could be exchangeable for other CBDCs or stablecoins or cryptocurrencies according to the definition of smart contracts. This could increase liquidity between different currencies and improve global trade. Moreover, this could simplify transfers between individual currencies and reduce transaction costs.

III.4. Central Bank Digital Receipts (CBDR)

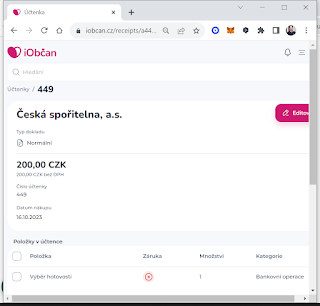

CBDR is a new concept that represents a digital receipt or document issued for each transaction within CBDC+. These receipts could be used for tracking transactions, controlling money laundering, and other purposes, such as tracking tax obligations. CBDR would also help increase user trust in the CBDC+ system and ensure privacy protection. In a very generalized view, a CBDR is a form of a dormant smart contract stored in DLT, which is activated under certain conditions or events, such as a transaction, complaint, further resale, or compliance with certain regulatory requirements, such as a tax audit.

IV. Advantages of CBDC+

CBDC+ offers a range of benefits that could contribute to the faster expansion and implementation of CBDCs and enhance their operation:

IV.1. Easy integration into existing systems - by viewing CBDC as a stablecoin, CBDC+ can be easily and quickly integrated into existing payment and treasury systems.

IV.2. Increased transparency and efficiency - smart contracts and CBDR allow for better transaction control and reduce the risk of money laundering and tax evasion.

IV.3. Reduction of transaction costs - the multi-currency nature and easy exchangeability of CBDC+ could lead to a reduction in transaction costs and a simplification of international trade.

IV.4. Support for digital and financial inclusion - CBDC+ can improve access to financial services for those who are currently excluded from the traditional banking system.

IV.5. Support for innovation - Integration with technologies such as smart contracts could lead to the creation of new financial instruments and services, which could be used in the future within an economy based on CBDC+.

IV.6. Reducing the risk of instability - Maintaining the stability of CBDC+ value and their link to traditional currencies could reduce the risk of instability often associated with volatile cryptocurrencies.

V. Conclusion

CBDC+ is an innovative concept that combines the benefits of classic CBDCs with additional features inspired by cryptocurrencies and blockchain technology. This model offers a range of benefits that can contribute to the faster expansion and better functioning of CBDCs, while also improving the efficiency, transparency, and security of financial transactions.

Despite increased transparency and transaction control, the CBDC+ system should be designed to ensure user privacy and minimize the risk of personal data misuse through the implementation of the principle of the Chinese wall.

Successful implementation and operation of CBDC+ also require cooperation among central banks of various countries. This cooperation could lead to a better understanding and resolution of issues related to digital currencies and contribute to the harmonization of regulations and standards in the field of CBDC.

VI. Future of CBDC+

CBDC+ is just one of many concepts currently being explored in relation to CBDCs. Although this concept offers a range of potential benefits, it is also important to consider the risks and challenges associated with its implementation. In the future, it will be important to carefully monitor the development of CBDC+ and other alternative concepts and ensure that these innovations are adopted responsibly and in line with the needs of users and the economy as a whole.

Komentáře

Okomentovat